In today’s unpredictable world, financial stability is more important than ever. One sudden medical bill, job loss, or unexpected expense can throw your finances into chaos. That’s where an emergency fund comes in—a safety net that keeps you financially secure when life surprises you.

In this article, you’ll learn why an emergency fund is essential and how to build one step-by-step.

What Is an Emergency Fund?

An emergency fund is money you set aside for unplanned expenses or financial emergencies. It’s not for vacations, shopping, or luxury items. Instead, it’s meant for situations like:

- Medical emergencies

- Job loss or reduced income

- Car or home repairs

- Sudden travel for family needs

Think of it as your financial insurance—without monthly premiums.

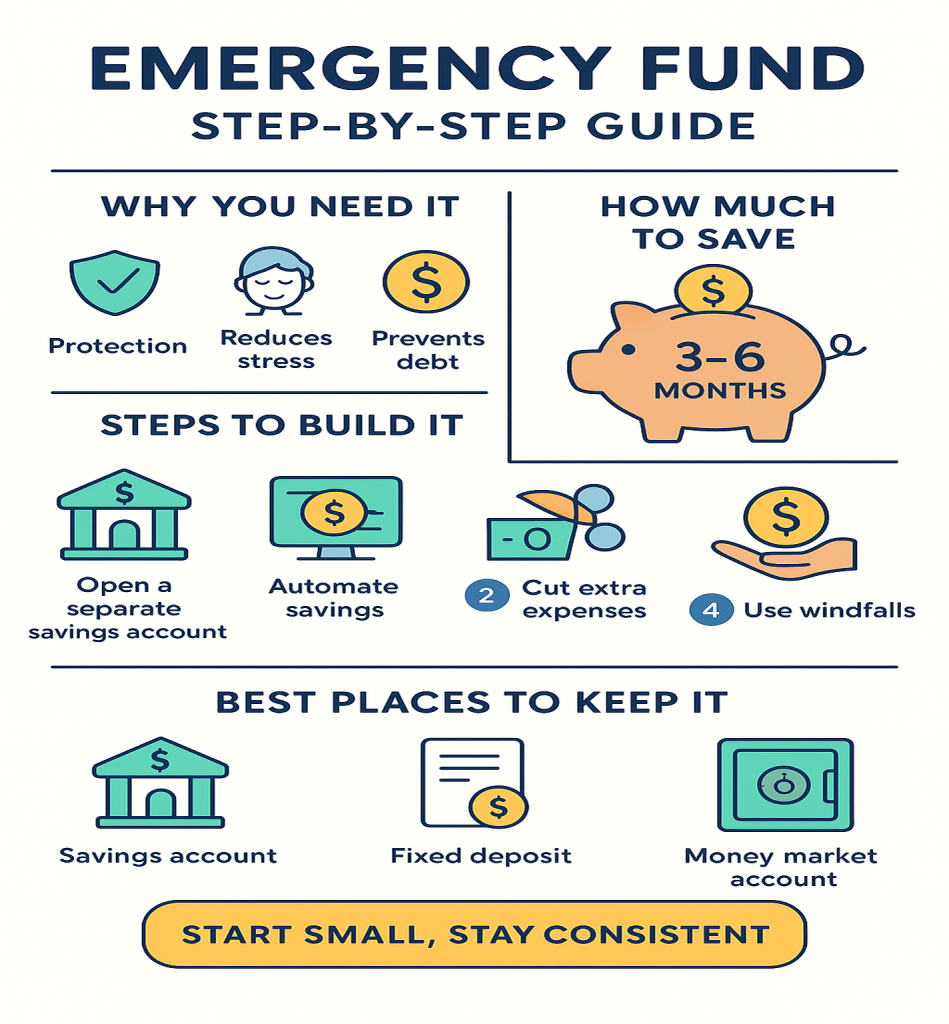

Why You Need an Emergency Fund

1. Protects You from Debt

Without savings, people often turn to credit cards or loans during emergencies. An emergency fund helps you avoid high-interest debt.

2. Reduces Financial Stress

Knowing you have backup money brings peace of mind and reduces stress about “what if” situations.

3. Prevents Lifestyle Disruption

If you lose your job, your emergency savings help you pay bills and cover essentials until you find new income.

4. Increases Financial Confidence

When you have a cushion, you can make better financial decisions without panic.

How Much Should You Save in an Emergency Fund?

Financial experts recommend saving 3–6 months of living expenses.

For example, if your monthly expenses are ₹40,000 (or $500):

- Minimum = ₹1,20,000 ($1,500)

- Ideal = ₹2,40,000 ($3,000)

Start small—even ₹500 ($10) a week adds up over time.

How to Build an Emergency Fund

1. Set a Clear Goal

Decide how much you need—start with a small milestone like ₹10,000 ($200), then aim higher.

2. Open a Separate Savings Account

Keep emergency money separate from daily spending so you’re not tempted to use it.

3. Automate Savings

Set up an automatic transfer every week or month. Even small, regular deposits grow big over time.

4. Cut Unnecessary Expenses

Skip non-essential purchases and redirect that money into your emergency fund.

5. Use Windfalls Wisely

Tax refunds, bonuses, or side-hustle income can quickly boost your savings.

6. Avoid Touching It for Non-Emergencies

Discipline is key. Use it only for true emergencies.

Best Places to Keep an Emergency Fund

Your emergency savings should be safe, liquid, and accessible. Good options include:

- High-yield savings account

- Fixed deposit with easy withdrawal

- Money market account

Avoid risky investments (stocks, crypto) for emergency funds.

Final Thoughts

An emergency fund is your first step toward financial freedom. It shields you from debt, reduces stress, and ensures stability in tough times. Start small, stay consistent, and build your financial safety net today.

Remember: It’s not about how much you save in one go—it’s about building a habit of saving.