Your credit score plays a major role in your financial life. Whether you’re applying for a loan, credit card, or even renting a home, lenders and landlords check your score to assess your reliability. A higher score means better loan approvals, lower interest rates, and more financial opportunities. The good news? You can improve your credit score with the right strategies.

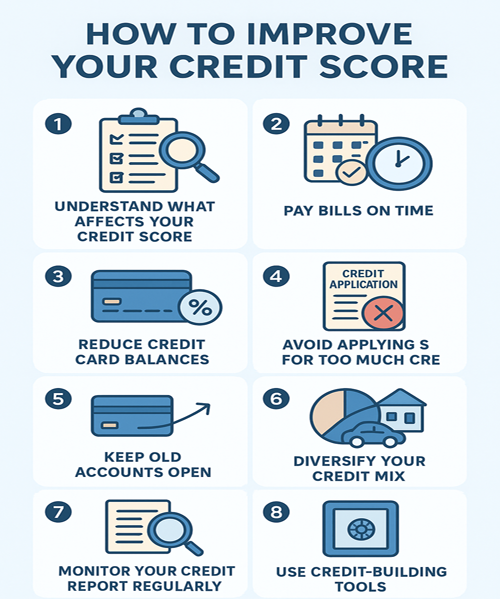

1. Understand What Affects Your Credit Score

Credit scores are calculated based on several factors:

- Payment History (35%) – Timely payments improve your score.

- Credit Utilization (30%) – Keep balances low compared to your limits.

- Credit Age (15%) – Older accounts boost your credibility.

- Credit Mix (10%) – A mix of credit cards, loans, and mortgages helps.

- New Credit Inquiries (10%) – Too many applications can hurt your score.

Understanding these factors is the first step to boosting your credit.

2. Pay Bills on Time

Late payments can severely damage your credit score. Automate bill payments or set reminders to avoid missed due dates. Even a single late payment can stay on your credit report for up to 7 years.

3. Reduce Credit Card Balances

High balances signal financial stress to lenders. Aim to keep your credit utilization below 30% of your total credit limit. For example, if you have a ₹1,00,000 limit, try to keep your balance under ₹30,000.

4. Avoid Applying for Too Much Credit

Each new application triggers a hard inquiry, which may lower your score. Only apply for credit when necessary, and avoid opening multiple accounts at once.

5. Keep Old Accounts Open

Even if you don’t use a card frequently, keeping old accounts open helps maintain your credit history length, which positively impacts your score.

6. Diversify Your Credit Mix

Lenders prefer to see you manage different types of credit responsibly, such as a mix of credit cards, car loans, and personal loans. But don’t borrow money just to build credit—be strategic.

7. Monitor Your Credit Report Regularly

Errors in your credit report can hurt your score. Request a free copy of your report and check for mistakes such as incorrect balances or unauthorized accounts. If you spot errors, dispute them with the credit bureau immediately.

8. Use Credit-Building Tools

If you’re new to credit or rebuilding, consider:

- Secured credit cards

- Credit-builder loans

- Authorized user status on someone else’s account

These tools can help you build a strong history over time.

Final Thoughts

Improving your credit score doesn’t happen overnight, but with consistent effort, you can see results within a few months. By paying bills on time, lowering balances, and monitoring your report, you’ll not only improve your score but also unlock better financial opportunities.