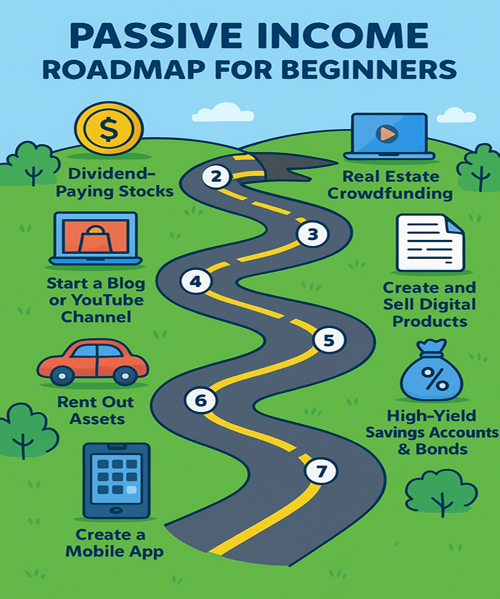

If you’ve ever dreamed of making money without constantly working for it, passive income is the key. Unlike a regular job where you trade time for money, passive income allows you to build systems, investments, or digital assets that continue to generate income even when you’re not actively involved.

For beginners, it may sound complicated, but the truth is that anyone can start building passive income streams with the right approach. Below are some beginner-friendly passive income ideas to help you get started.

1. Dividend-Paying Stocks

Investing in dividend stocks allows you to earn regular payouts from companies without selling your shares. Over time, you can reinvest dividends to grow your wealth faster. Beginners can start small with fractional shares or exchange-traded funds (ETFs).

2. Real Estate Crowdfunding

Don’t have enough money to buy a property? With real estate crowdfunding platforms, you can invest small amounts into rental or commercial properties and earn a share of the profits through rent and appreciation.

3. Start a Blog or YouTube Channel

Content creation is one of the most popular ways to generate passive income. Once your blog or channel gains traffic, you can earn from:

- Google AdSense

- Affiliate marketing

- Sponsored posts

- Digital products

Though it takes time to grow, the income can continue for years.

4. Affiliate Marketing

Promote other people’s products through affiliate links on your blog, website, or social media. Each time someone makes a purchase through your link, you earn a commission. It’s a low-cost way for beginners to start generating passive income online.

5. Create and Sell Digital Products

Digital products like eBooks, templates, or online courses can be created once and sold repeatedly. Platforms like Gumroad, Teachable, and Etsy make it simple to sell globally.

6. Peer-to-Peer (P2P) Lending

P2P lending platforms let you lend money to individuals or small businesses in exchange for interest payments. While there’s some risk, it can be a steady source of passive income if done wisely.

7. Rent Out Assets

Passive income doesn’t always require digital skills. You can rent out:

- A spare room on Airbnb

- Your car on rental platforms

- Equipment like cameras, tools, or bikes

This way, your assets work for you instead of sitting idle.

8. Invest in Index Funds

Index funds and ETFs are beginner-friendly investment options that track market indexes. They require little management and provide consistent long-term growth and dividends.

9. High-Yield Savings Accounts & Bonds

Not the highest return, but safe and steady. Parking your money in high-yield savings accounts or government bonds ensures you earn passive income with minimal risk.

10. Create a Mobile App

If you have coding knowledge—or can hire a developer—you can create a simple app. Once it gains users, you can earn from ads, in-app purchases, or subscriptions.

Final Thoughts

Building passive income takes patience and effort upfront, but once established, it can provide financial freedom and stability. Beginners should start with small, low-risk options and gradually scale into bigger opportunities.

Remember: the earlier you start, the more time your passive income has to grow.