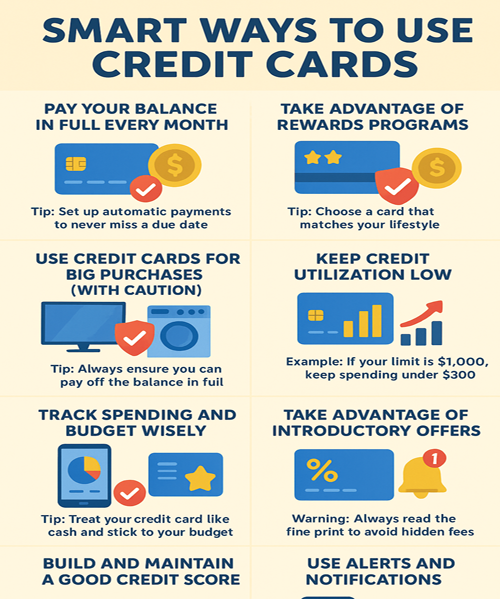

Credit cards are powerful financial tools when used wisely. They offer convenience, rewards, and security, but if mismanaged, they can lead to debt and financial stress. The key is learning smart ways to use credit cards so you can enjoy the benefits while avoiding the pitfalls.

1. Pay Your Balance in Full Every Month

The smartest way to use a credit card is to avoid carrying debt. Paying your balance in full ensures you don’t pay interest and helps build a strong credit history.

👉 Tip: Set up automatic payments to never miss a due date.

2. Take Advantage of Rewards Programs

Many credit cards offer cashback, travel points, or discounts. Using your card for regular expenses like groceries, fuel, or bills can help you earn rewards without overspending.

👉 Tip: Choose a card that matches your lifestyle (cashback for daily shopping or travel rewards if you travel often).

3. Use Credit Cards for Big Purchases (with Caution)

Credit cards provide purchase protection, extended warranties, and fraud security. When making big-ticket purchases like electronics or appliances, using your credit card can give you added safety.

👉 Tip: Always ensure you can pay off the balance in full.

4. Keep Credit Utilization Low

Your credit utilization ratio (how much credit you use compared to your limit) plays a big role in your credit score. Experts recommend keeping it below 30%.

👉 Example: If your limit is $1,000, keep spending under $300.

5. Track Spending and Budget Wisely

Using credit cards doesn’t mean overspending. Link your card with budgeting apps or bank alerts to monitor expenses in real time.

👉 Tip: Treat your credit card like cash and stick to your budget.

6. Take Advantage of Introductory Offers

Many cards offer 0% APR or bonus rewards for new users. If you plan a big purchase or balance transfer, these offers can save money.

👉 Warning: Always read the fine print to avoid hidden fees.

7. Build and Maintain a Good Credit Score

Responsible credit card use helps you build a strong credit history, which is essential for loans, mortgages, or even job applications.

👉 Tip: Pay on time, keep balances low, and avoid applying for too many cards at once.

8. Use Alerts and Notifications

Most banks allow you to set spending alerts, due date reminders, and fraud alerts. This helps you stay in control and avoid late fees.

Final Thoughts

Credit cards are not the enemy—they’re tools. By following these smart ways to use credit cards, you can enjoy rewards, build your credit score, and stay financially secure. The trick is discipline: spend wisely, pay on time, and always use credit to your advantage, not against it.