Planning for retirement might seem overwhelming, but starting early can make a huge difference in how financially secure and stress-free your golden years will be. Retirement planning is not just about saving money—it’s about building a lifestyle that allows you to live comfortably without worrying about financial struggles.

In this guide, we’ll cover the basics of retirement planning, including why it’s important, how to start, and strategies to maximize your savings.

Why Retirement Planning is Important

- Financial Security – It ensures you’ll have enough funds to cover living expenses after you stop working.

- Freedom & Flexibility – Proper planning gives you the freedom to travel, pursue hobbies, and enjoy life without money stress.

- Healthcare Costs – Medical expenses often rise with age, and retirement savings help cover unexpected costs.

- Inflation Protection – Long-term investments can help your savings grow and protect against inflation.

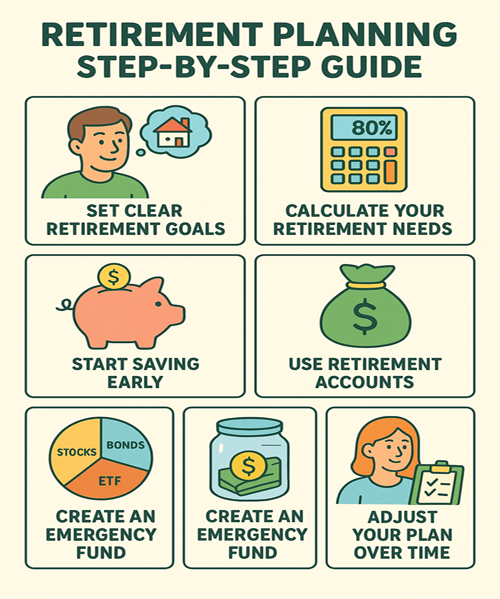

Steps to Start Retirement Planning

1. Set Clear Retirement Goals

- At what age do you want to retire?

- What kind of lifestyle do you envision (travel, hobbies, minimalistic, etc.)?

- Estimate how much annual income you’ll need in retirement.

2. Calculate Your Retirement Needs

A common rule is that you’ll need 70–80% of your pre-retirement income to maintain your lifestyle after retirement.

3. Start Saving Early

The earlier you start, the more you benefit from compound interest. Even small contributions can grow significantly over decades.

4. Use Retirement Accounts

- 401(k) or Pension Plans (if available from your employer).

- IRAs or Roth IRAs for tax-advantaged savings.

- Government retirement schemes (like NPS in India, Social Security in the US).

5. Diversify Investments

Don’t rely on just one source. Balance your portfolio with:

- Stocks (for growth)

- Bonds (for stability)

- Mutual Funds / ETFs

- Real Estate Investments

6. Create an Emergency Fund

Always keep 6–12 months of expenses aside. This prevents you from dipping into retirement funds early.

7. Adjust Your Plan Over Time

As life changes (marriage, kids, promotions, health), keep revisiting and adjusting your retirement strategy.

Common Retirement Mistakes to Avoid

❌ Starting too late

❌ Not investing enough

❌ Relying only on one income stream

❌ Ignoring healthcare costs

❌ Forgetting about inflation

Final Thoughts

Retirement planning doesn’t have to be complicated. By starting early, setting clear goals, and diversifying your investments, you can build a financially secure future. The key is consistency—small, disciplined steps today will create a stress-free retirement tomorrow.